| Apr 11, 12 | -746 | 0% | 25% | SHORT | -1 | ▼ | |

| Apr 12, 12 | -716 | 1% | 23% | SHORT | 2 | ||

| Apr 13, 12 | -742 | 0% | 21% | SHORT | -5 | ▼ | |

| Apr 16, 12 | -762 | 0% | 19% | SHORT | -4 | ▼ | ▼ |

| Apr 17, 12 | -694 | 3% | 17% | SHORT | 6 | ▲ | |

| Apr 18, 12 | -702 | 3% | 15% | SHORT | -3 | ||

| Apr 19, 12 | -710 | 2% | 14% | SHORT | -3 | ||

| Apr 20, 12 | -684 | 4% | 12% | SHORT | 1 | ▲ | ▲ |

| Apr 23, 12 | -852 | 0% | 11% | SHORT | -24 | ▼ | ▼ |

| Apr 24, 12 | -850 | 0% | 9% | SHORT | -1 | ▼ | |

| Apr 25, 12 | -702 | 7% | 7% | LONG | 13 | ▲ | |

| Apr 26, 12 | -570 | 12% | 6% | LONG | 12 | ▲ | ▲ |

| Apr 27, 12 | -352 | 22% | 6% | LONG | 20 | ▲ | ▲ |

HOW TO INTERPRET:

after the indicated date,

the first positive(negative) number is

the TIDE number for that day (TIDE NUMBER is obtained adding two

indicators, a short term indicator & a long term indicator)

the percentage number, that follow(can

vary from 0% to 100%) represent today result on a percentile position

respect to the tide numbers of the last three months (for example 0%

means that today TIDE number is the worst result in the last three

months)(100% means that today TIDE number is the best result in the

last three months),

the following percentage number

indicate the 20 days moving average of the previous percentage

number.

SHORT(LONG) indicate that the short

term indicator number is lower than the long indicator number

(indicate that the short term indicator number is higher than the

long indicator number),

the last number compare today tide to

previous tide number and the difference between the two is tabulated

and compared with all the previous results

For the last number, value sitting

between -9 to +9 indicate days with no particular weight, double

digit positive or negative days are important movements, specially if

repeated in consequent days)

Added

arrow up(down), up when today result is the maximum of the last 4

days, down when today result is the minimum of the last four

days.

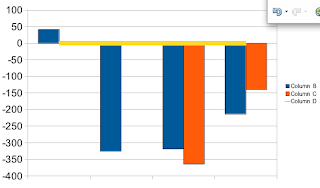

the TIDE profile graph composed of four set of columns,

the first set from left is the Tide number 3 weeks ago

the second set from left is the Tide number 2 weeks ago

the third set from left is the Tide number 1 week ago

the fourth set from left is the Tide number for the last market day

the orange column represent the short term indicator result

the dark blue column represent the long term indicator result

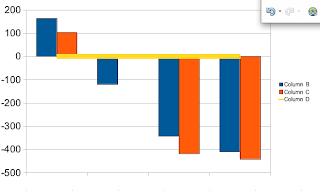

the TIDE profile graph composed of four set of columns,

the first set from left is the Tide number 3 weeks ago

the second set from left is the Tide number 2 weeks ago

the third set from left is the Tide number 1 week ago

the fourth set from left is the Tide number for the last market day

the orange column represent the short term indicator result

the dark blue column represent the long term indicator result

Added

arrow up and arrow down, up when today result is the maximum of the

last 4 days, down when today result is the minimum of the last four

days. Just an added service